Fortune favors the bold… In real estate, fortune favors the creative, the humble, and the informed!

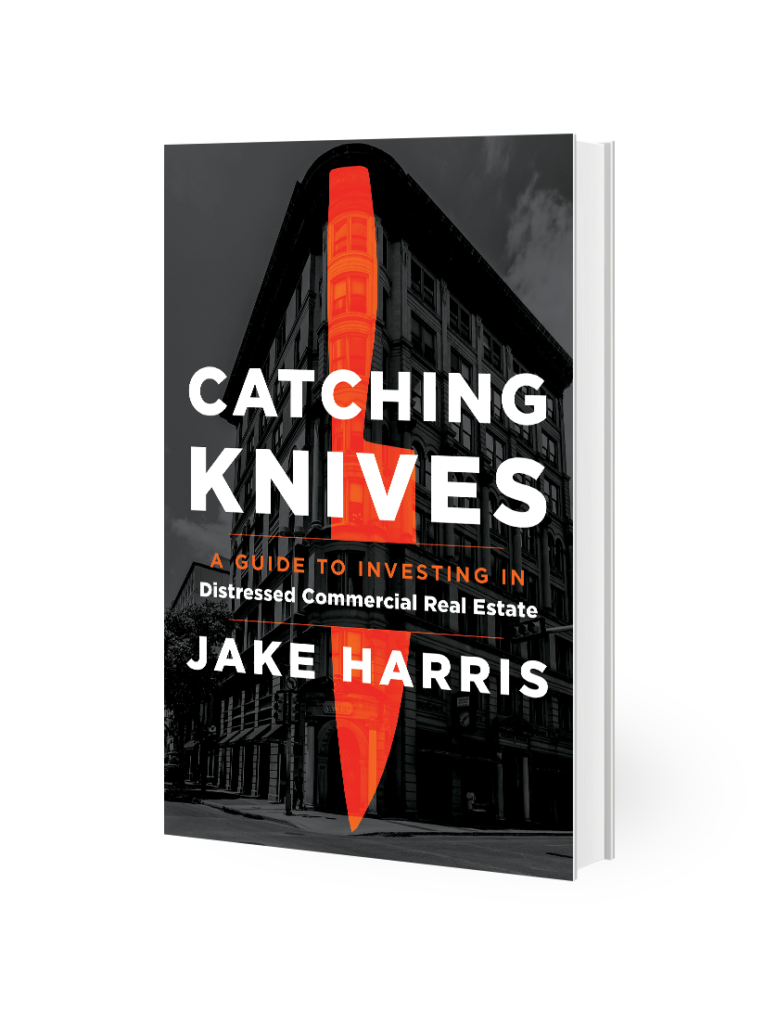

One reason why I wrote “Catching Knives” was to prepare anyone interested in real estate so they could be ready for whatever might happen because the reward is in the calculated risk.

There is a lot of risk in distressed real estate. It’s incredibly overwhelming to make a decision, and when you do, you’re still sitting with your fingers crossed that things go by smoothly.

I’m sure you’re thinking, “Jake, do you want me to do this or not?” I get it. I think you should do it. Absolutely. All the rewards are in the risks. The very CALCULATED RISKS in the market should be the ones taken.

With that said, these are the risks that need to be considered before signing the dotted line.

What is the potential?

What does this property have? Is it a great location? Is it by historic landmarks? When I first discovered my passion for real estate, I was in construction. I need to tell you that has helped me immensely in calculating risk in distressed markets. I can tell how much time it will take to give a property the remodel it needs to see its full potential. More often than not, I can see the potential to be much more than anything I initially invest, even with upgrades.

Here’s the deal, having a baseline of construction knowledge will help you when negotiating with contractors. Being able to understand that potential will keep you from taking any unnecessary losses. Again, the reward is in the calculated risk.

Considering the financial push, could you swing construction lasting over a year and still be able to make the investment back after the fact?

Risks can lead (and probably will lead) to setbacks.

Nothing much to elaborate beyond that. The reality is that you can do everything right and some things will fall through the cracks. What matters is having a team you trust BEFORE making any big investments.

That means having a beginner understanding of construction, real estate agents, brokers, and lawyers you can connect with to help you navigate murky waters.

Let me tell you, even in my career when things go haywire, I know I’ll bounce back. You will too, sometimes it just takes time (and money).

There are risks you can’t see.

Piggybacking off our last point, there is no crystal ball that we can look into that can help us make the best deals possible.

If you see the distressed property and it is an incredible deal, deeply consider this: real estate is not thrifting, and if something is a great deal, it’s coming at a greater expense down the line. Beyond the legalities of closing on properties, consider that properties hold a history that isn’t always shared with us. Always be wary. If something sounds too good to be true, it usually is.

With this in mind, I’ll add this final point, your due diligence is always going to be the foundation of a calculated risk. You cannot have an upper hand in a market that you’re not invested in. Researching real estate is always the first step.

I elaborate more on this on The DJE Multifamily Podcast. If you want to learn more, you can listen to it here.